How We Came About

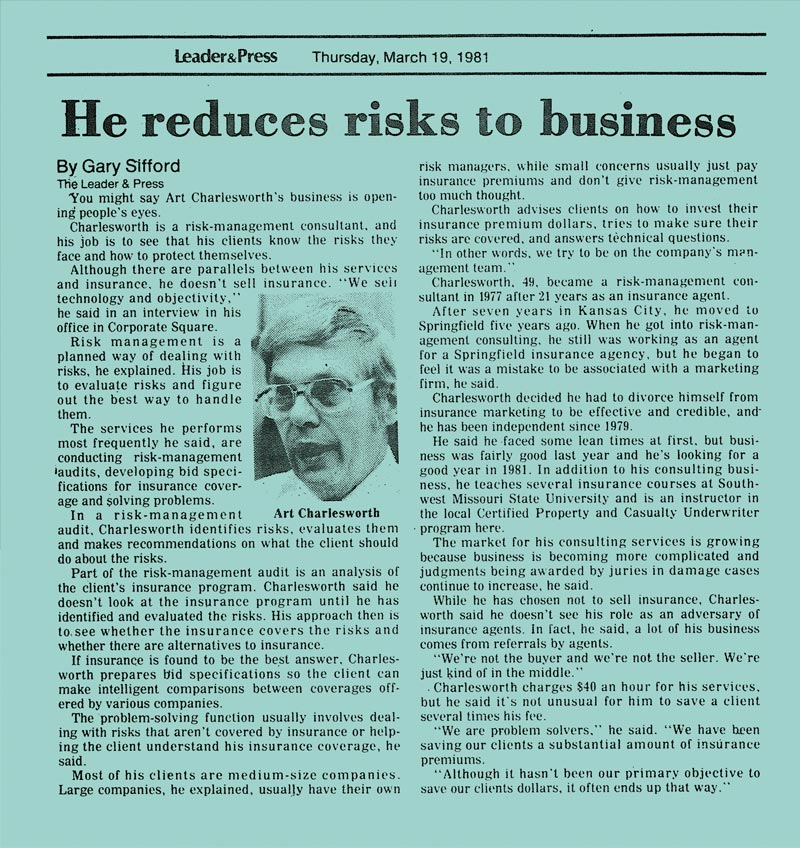

Our history dates back to 1977, when Art Charlesworth took the insurance world by storm, founding Charlesworth & Associates, L.C. His business focused on consulting without selling any insurance products…a concept we still adhere to today.

In the 1980s, three of Art’s children joined the family-run business, and when Art retired in 2000, those three children, James, Bob, and Connie, took over the business to carry on the family tradition.

As the business grew, it was apparent group benefit consulting was becoming increasingly important to clients and consulting services in that line of business was critical. In 2001, we formed Charlesworth Benefits, L.C.

Knowing collaboration and a streamlined approach was key, we merged both businesses in 2018 to create Charlesworth Consulting.

In 2020, we expanded further and opened an office in Dallas, Texas.

Our Charlesworth family has always operated on the principles of being objective, innovative, and personal. Our promises to all clients are outlined below.

We work to fully understand every client’s culture and overall benefit objectives. It is only then we can truly provide effective consulting.

We think critically, are completely objective, and provide an opinion. Clients find we speak frankly — a major benefit in the work we do.

We work to be proactive as best as we possibly can to avoid coverage or financial surprises.

We respect clients and carriers. We try to find a positive balance using each member’s talents to meet our clients’ goals without creating an unhealthy working relationship with our vendors.

We respond timely to clients’ requests. An old saying in our office is “We would rather have the information on your desk than ours!” While we do travel quite a bit, we are never really out of touch. We strive to be a supportive business partner to our clients.

We recognize benefits are personal. We know every person is different on how plans may impact them. What seems inconsequential to us may not be for a client or its employees. It may not change our recommendation, but it doesn’t fall on deaf ears as we look out after all those impacted by insurance and risk management plans.

What We Do

Our approach to clients is not as an insurance agent or salesperson, but rather as a consultant specializing in risk management.